The smart Trick of Home Loan Lender That Nobody is Talking About

Table of ContentsSome Known Details About Clark Finance Group Mill Park The Facts About Clark Finance Group UncoveredMortgage Broker for DummiesClark Finance Group Home Loan Lender for Dummies

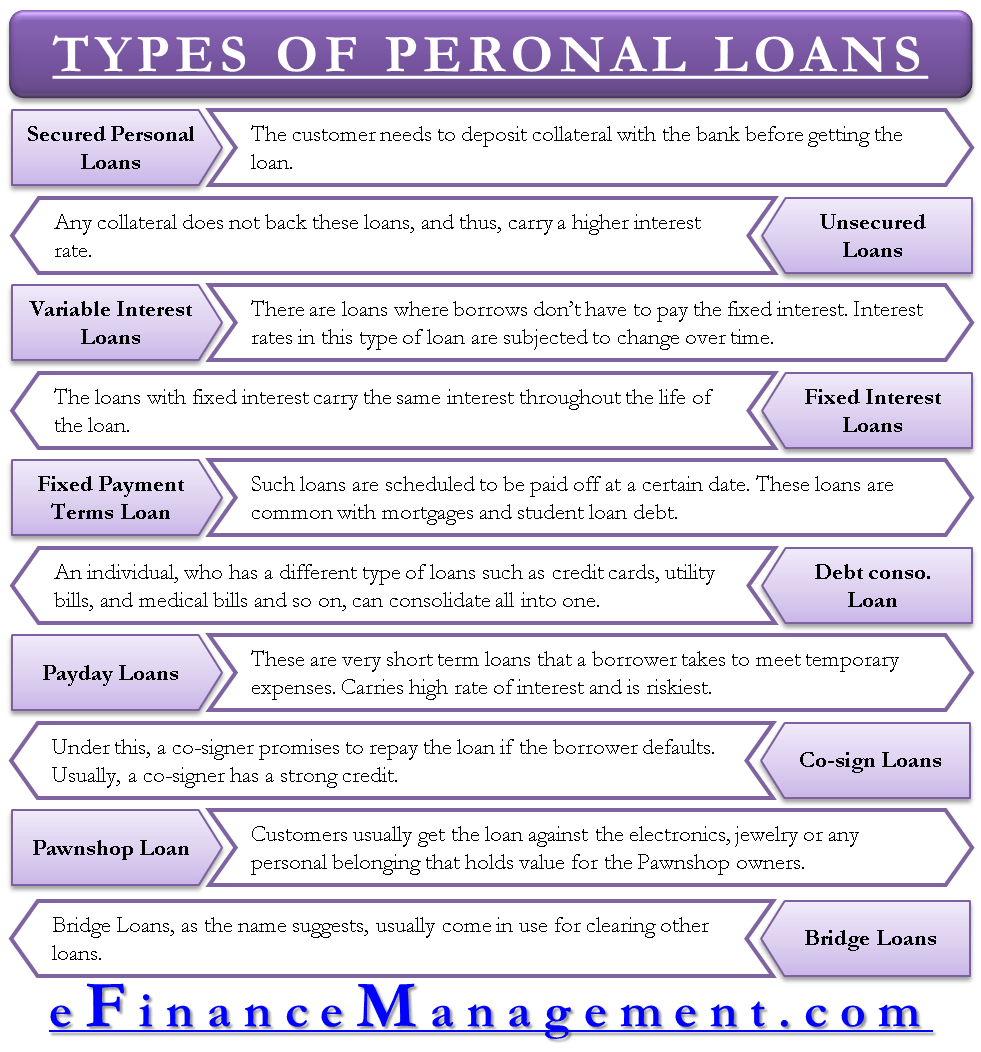

That's why we give attributes like your Authorization Probabilities and savings estimates. Naturally, the deals on our system do not stand for all monetary items out there, however our objective is to show you as many great choices as we can. All car loans aren't developed equivalent. If you need to borrow cash, initially, you'll intend to decide which sort of funding is right for your scenario.

If you have high-interest bank card financial obligation, an individual finance might aid you repay that financial debt earlier. To consolidate your financial obligation with an individual lending, you 'd use for a loan in the quantity you owe on your debt cards. Then, if you're approved for the full amount, you 'd use the funding funds to pay your credit scores cards off, rather making regular monthly settlements on your personal lending.

That's because the loan provider may consider a safeguarded financing to be much less risky there's an asset backing up your loan. If you don't mind pledging security as well as you're positive you can repay your financing, a secured car loan might aid you save money on interest. When you utilize your security to obtain a car loan, you run the risk of shedding the home you provided as security.

Clark Finance Group Fundamentals Explained

You'll take an item of worth, like a piece of precious jewelry or a digital, right into a pawn shop and also borrow cash based on the item's worth. Financing terms vary based on the pawn store, and interest prices can be high.

You may additionally get struck with fees and added prices for storage space, insurance coverage or renewing your car loan term. Payday alternative loan quantities range from $200 to $1,000, and also they have longer settlement terms than payday loans one to six months rather of the common couple of weeks you obtain with a cash advance finance.

A house equity finance is a kind of protected lending where your residence is made use of as collateral to obtain a round figure home renovation loan of cash. The amount you can borrow is based upon the equity you have in your house, or the distinction in between your residence's market value and just how much Read More Here you owe on your house.

Given that you're using your house as collateral, your rate of interest with a house equity loan might be less than with an unsecured individual finance. You can utilize your house equity finance for a variety of objectives, varying from house renovations to clinical bills. Before taking out a residence equity funding, see to it the settlements remain in your budget plan.

The Facts About Home Loan Lender Revealed

She delights in aiding people discover methods to much better manage their money. Her work can be found on countless web sites, including Bankrate, Finance, Bu Find out more. Learn more.

Below are the most usual kinds of financings as well as how they function. Trick Takeaways Personal finances and credit score cards come with high passion rates but do not require collateral.

Cash loan commonly have extremely high rate of interest plus purchase costs. Individual Fundings Many financial institutions, online and also check over here on Main Street, use personal car loans, and also the profits might be made use of for virtually anything from acquiring a brand-new 4K 3D wise TV to paying costs. This is a pricey means to obtain money, because the finance is unprotected, which implies that the borrower does not put up collateral that can be seized in situation of default, similar to an auto loan or home mortgage.

The 8-Minute Rule for Home Loan Lender

Interest prices can be more than 3 times that amount: Avant's APRs vary from 9. 95% to 35. 99%.

Small business loan vs. Financial institution Warranty A small business loan is not the like a bank assurance. A financial institution might release a warranty as surety to a 3rd party in behalf of one of its clients. If the client fails to meet the pertinent contractual commitment with the 3rd event, that party can require settlement from the bank.

A company may accept a service provider's bid, for instance, on the condition that the specialist's financial institution concerns a warranty of repayment in case the service provider defaults on the contract. An individual car loan may be best for a person that requires to borrow a reasonably small quantity of cash and is certain of their capacity to repay it within a couple of years.